A Superficial Analysis of Past, Current, and Future UK Online Poker

Abstract

This report provided a superficial analysis of the UK online poker industry, and provided an estimate that the online poker market for the UK will shrink for the next two to three years, despite steady growth outlook for the whole online gambling market.

This report used multiple sensible data sources to analyse the contributing factors among consumer behaviours and demographic trends in the past 9 years, as well as market trends through monthly business data in the past three.

Main findings include a decreased interest in online poker participation, and a younger gambling community is currently being formed. Report investigated impact of gameplays involving chances within video games to the gambling industry, believing it to be responsible for decreasing interest and rejuvenation of gamblers.

Report also evaluated recent statements and findings made by UK Parliament and HMG and concluded that online poker and the whole online gambling market may be affected due to social responsibility concerns and further regulation of loot boxes and other games of chance in video games.

Report concluded, through findings, that firms interested in entering the online poker market should be cautious, and suggested alternatives such as online slots could be replacements worth further investigation. Report also mentioned that technological factors not covered could alter the outcome on a case-by-case basis.

Introduction

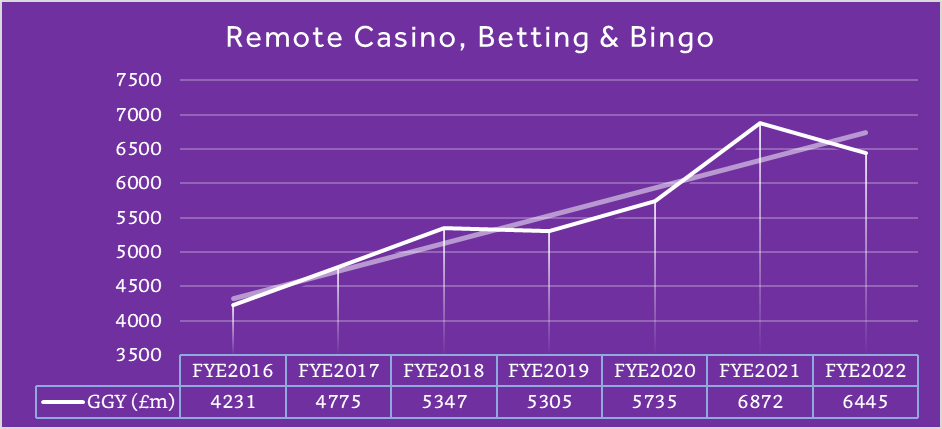

As we progress to the digital age, gambling is also progress to the Internet, and has been an option for many gamblers who do wish to be in bet houses. In fiscal year ending (FYE) 2022, the Gross Gambling Yield (GGY) of the whole online gambling industry is estimated to be £6.9 billion and is expected to slightly increase in size for the next 2-3 years despite slight decrease in FYE2022.

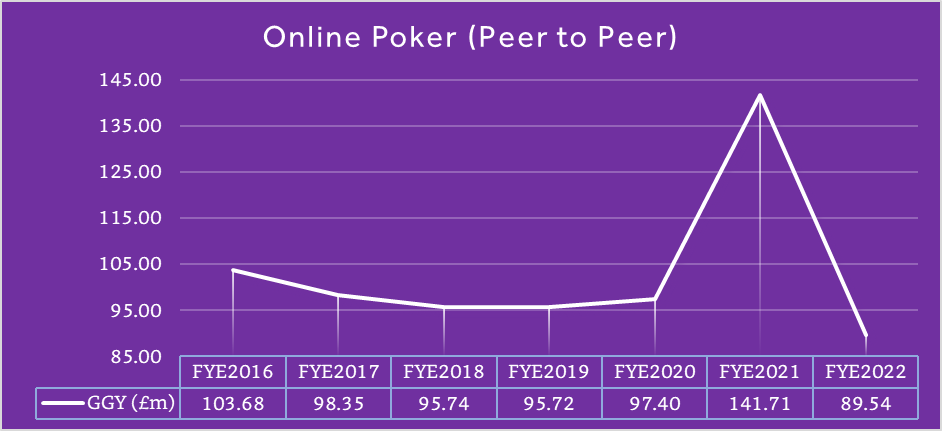

Poker has been one of the most established betting formats, and online poker was once one of the most popular games to play online. Currently, GGY for online poker bets are estimated to be £89.54 million in the FYE2022. Although GGY of this market has not been decreasing, I estimate this market to continue its trend to shrink in the next few years.

FYE2021 have witnessed a spike in all online gambling activities, related to COVID-19. However, this is only an isolated short occurrence.[1]

Although the UK has over one thousand licensed active gambling sites set up by 477 license holders, a rough estimate of poker providing websites is in small tens.[2]

Currently, primary players within the UK online gambling market include bet365, PaddyPower, Sky Bet, Betfred, and 888. Among them, PaddyPower and Betfred are large gambling companies with strong local presence, and Sky is a leading television and entertainment company.

Sociocultural Trends (Consumer Behaviours)

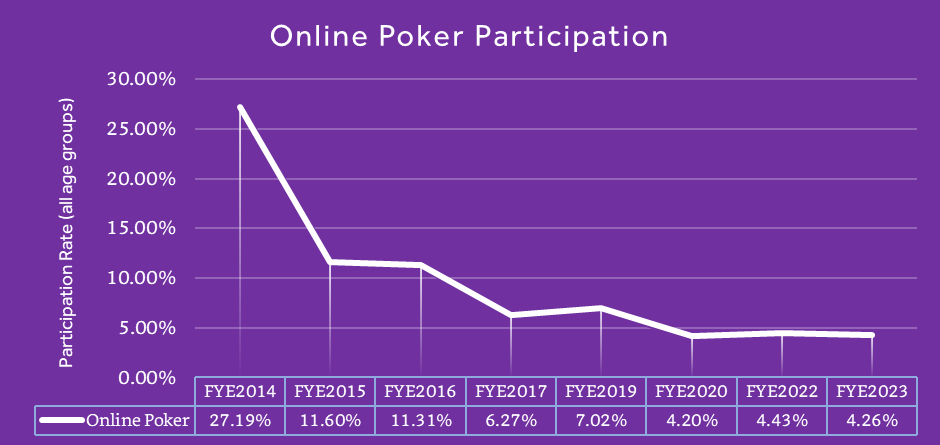

I analysed outcomes of surveys conducted to the UK residents from 2014 to 2023, specifically results related to online poker. Results have shown a strong decreasing trend for participation rate for online poker.

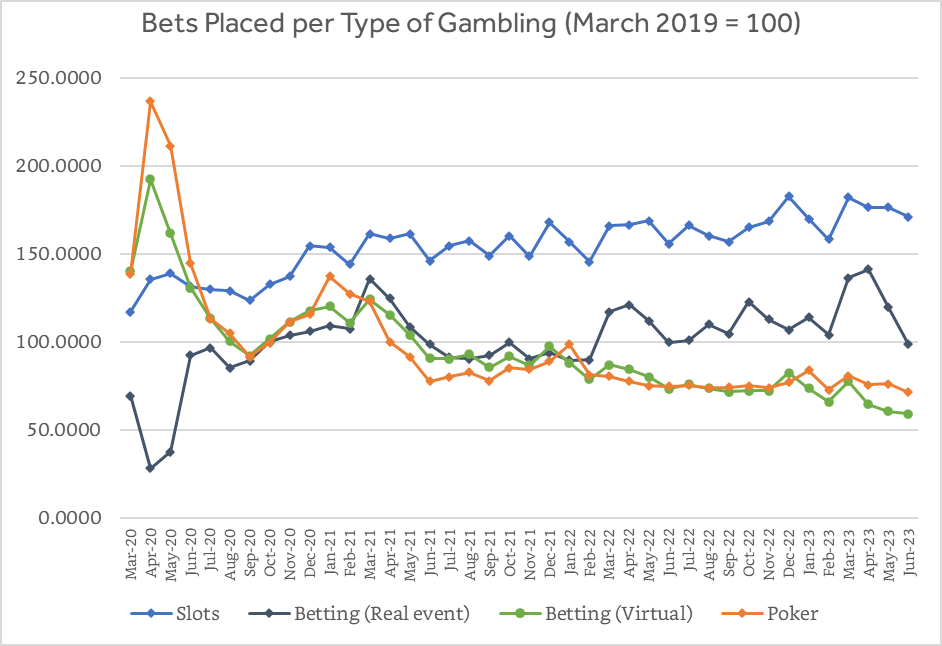

Data has also shown a sharp decrease from FYE2014 to FYE2015, and then halve every two years from FYE2015 to 2020, then remained comparatively steady until FYE2023. It is quite safe to conclude that there has not been a mentionable increasing trend as to participation rate of online poker, while there has been a quite significant decrease from FYE 2014 to FYE2020. Data also suggested a stable and decreasing outlook in terms of overall participation rate, which is also supported by monthly data of poker participation:

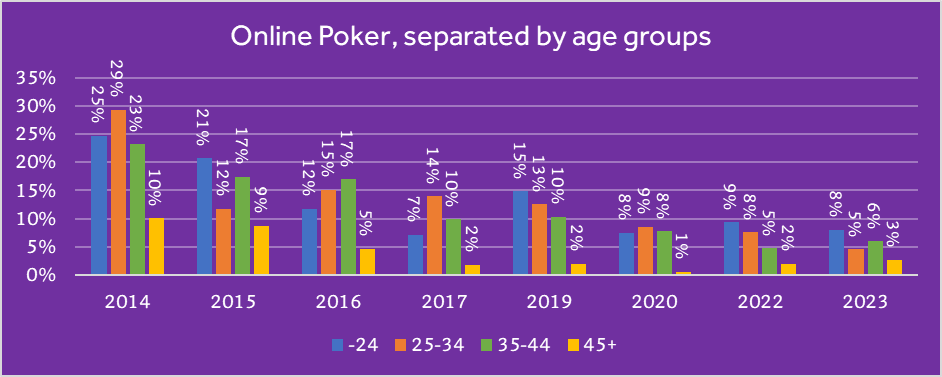

Further research on historical year-by-year data has revelled a demographical change of age group among online poker participants. It appears that in recent years, young people below 24 now have growing interest in online poker despite an overall decreased interest in UK population. It also shown that elder people tend to have significant less interest on online poker and have the lowest participation rate.

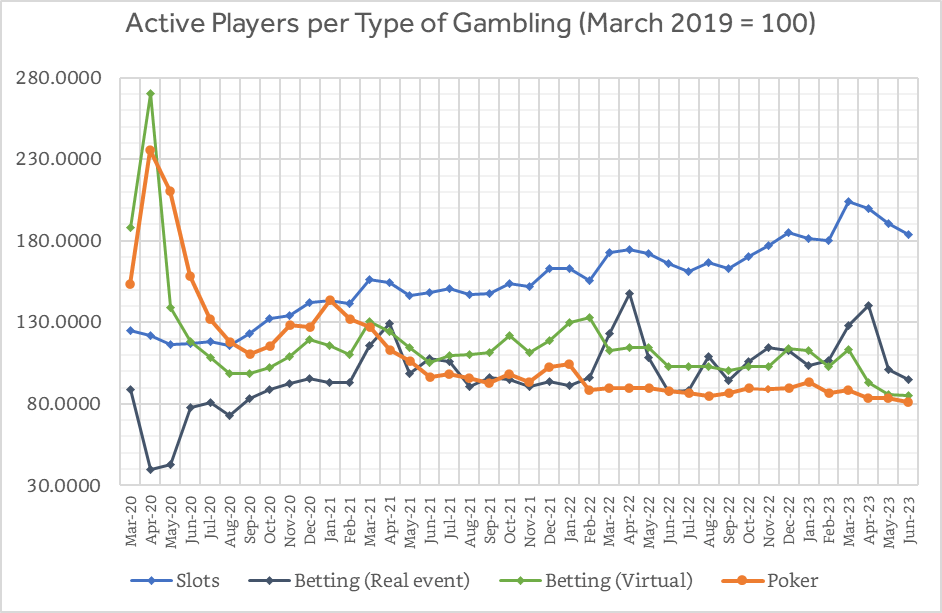

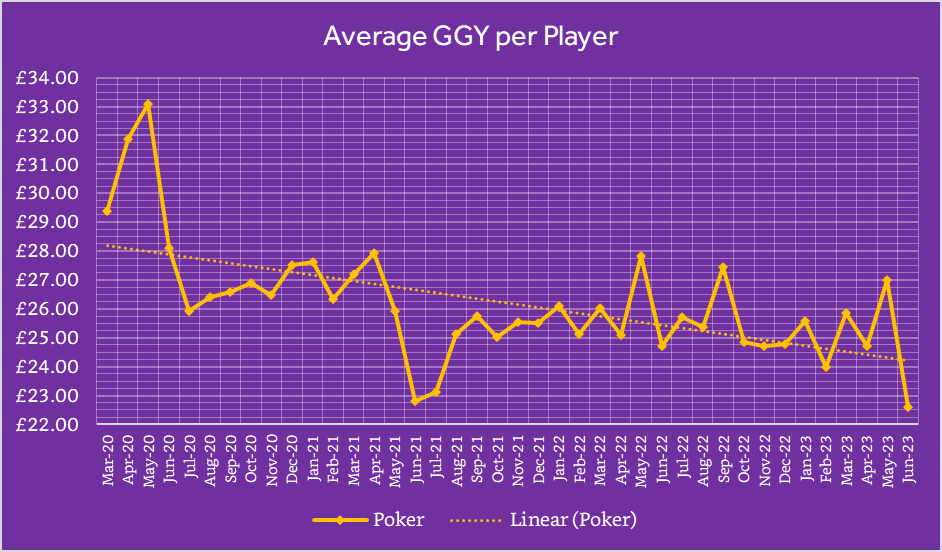

Worrying trend of having a younger online poker gambling community may pose concerns for both social responsibility and service providers’ ability to gain profits from players. We will discuss social responsibility concerns in Legal Factors; Recent data on GGY and player count have already shown a steady decreasing trend for profits poker table providers could made from each player:

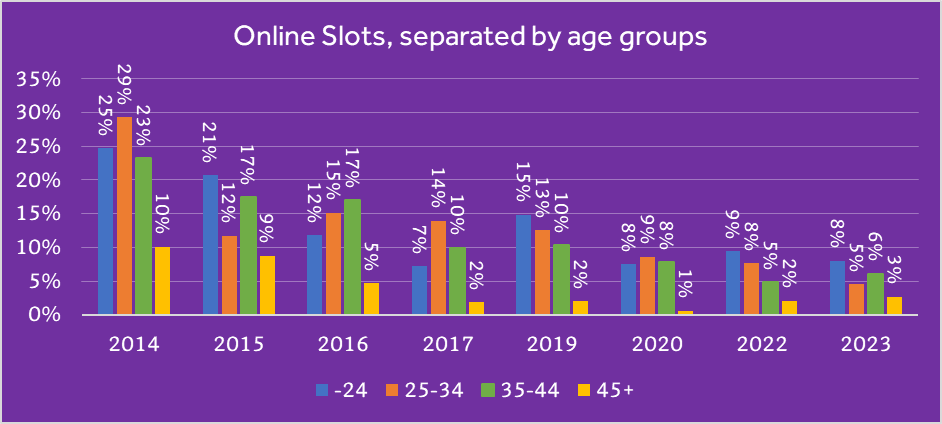

During investigation, I find abnormal increase in gambling activities for young adults not fully justified, and steady increasing participation in slots in recent years to be odd and may need further research. Turns out, age group distribution for online slots participation has remarkably similar trends in all age groups available:

Further reading in HM Government (HMG) reports have revealed existence of ‘loot boxes’ and ‘gacha pools,’ which attracts children and young adults.

Loot boxes are terribly like slots and could be considered a game of chance . The players acquire these boxes for money, and the items released due to the use of these boxes would have monetary values in legally questionable trading platforms. Gacha pools, as an inferior variant, requires users to acquire characters and resources through pulling randomised items out of pools, but items are usually not tradeable.

Both have potentially decreased participation rate of regulated commercial gambling but could also be seen as an introduction for young adults and adolescents as a guide to them as well. Similar forms of poker games have been emerging, especially targeting children, and have already raised interests of gambling experts’ years before.

I anticipate higher participation rate of young adults for both online poker and online slots may be a result of introduction by loot boxes and similar non-regulated protentional games of chance video games. However, their existence is also a strong factor for decreasing online participation because money and attention are paid to those platforms instead of regulated gambling due to lack of age requirements and continuity of playing.

Legal Factors (Regulation and Crime Prevention)

Recent demographic data summarised in Sociocultural Trends have shown younger the age, higher the participation rate for the UK society. HMG’s 2018 and 2019 report on 11-16 years old found 14% and 11% of the cohort had participated in any type of online gambling, despite they are banned by law to gamble.

Social responsibility concerns around underage gambling may lead to stricter laws and regulations to be imposed, and recommendations have been proposed starting three years before and is likely to be implemented.

Currently, the Gambling Commission requires all operators to know their clients. Yet, chances are that the participants could be using parents’ or grandparents’ information details and funds to play, in which case service provider may attract regulatory actions if they failed to take appropriate actions.

It has been long known that casinos both online and offline is potentially vulnerable to be used by money laundering criminals . Money laundering prevention is a legal obligation for online poker providers as casinos, and previous negligence have attracted regulatory actions as large fines. Such regulations are not expected to be loosen in the next few years and could be challenging for new providers to meet.

Problems of Loot Boxes have raised concerns from senior officials of HMG, including House of Lords and Children’s Commissioner, with some demanding immediate action taken. If loot boxes, and gacha games also, are to be regulated as gambling or in a similar method, then a noticeable decrease in online gambling, especially for youthful age groups, would be expected as gamblers of other age groups quit playing and having no fresh players.

Conclusion and Summary

It is my suggestion for recently established firms to be extremely cautious before the online poker business, based upon following observations:

- Since pandemic, player count and GGY for both poker and online bets has been decreasing compared to pre-pandemic data. Increase in players, GGY, and bets are temporarily fluctuations.

- Post pandemic, GGY for online poker has experienced a hard drop and is not expected to recover in the short run.

- Demographics data on online poker players suggest the player base to be young, and mid-age players are gradually quitting participation of poker.

- Unregulated loot boxes and poker video games are potentially attracting users away from commercial gambling.

- Social responsibility concerns may attract stricter regulations by law.

- Young participating trend may lead to risks associated with lack of underage verifications and bring regulatory actions.

- Online poker is potentially vulnerable to utilisation by illegal activities, such as money laundering, ill prevention will being regulatory actions.

- Regulation of Loot Box could lead to decrease of future players.

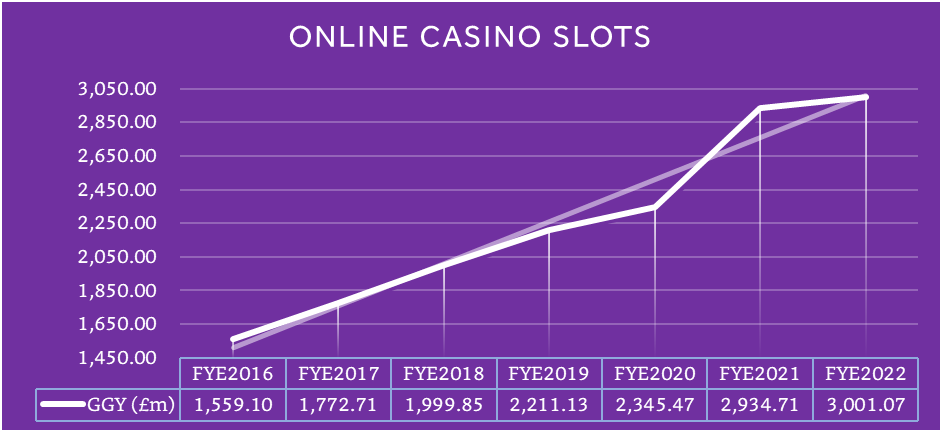

However, it may be worth considering for start-ups currently interested in online poker to conduct further research and assessment to participate and invest in contentious growing sectors of online casino services, such as Slots that was not affected by drops experienced by other types of online gambling:

Still, with technological sector not assessed as required, it could be possible for firms with leading or groundbreaking technologies to enter the online poker industry and remain profitable, but such should be considered on a case-by-case basis.

References

ABC PREMIUM NEWS. 2013. App ‘grooming’ children to gamble; Gambling experts have joined calls to ban an online pokie-style game available to children that requires users to spend real money.The game and others like it can also be accessed as mobile phone apps but are currently e. [online].

BELGIAN GAMING COMMISSION. Belgian Gaming Commission rules after analysis: “Paying loot boxes are games of chance”. [online]. Available from World Wide Web: <https://www.gamingcommission.be/opencms/opencms/jhksweb_en/gamingcommission/news/news_0061.html via Internet Archive>

GAMBLING COMMISSION (UK GOVERNMENT). 2022. £9.4m fine for online operator 888. [online]. Available from World Wide Web: <https://www.gamblingcommission.gov.uk/news/article/gbp9-4m-fine-for-online-operator-888>

GAMBLING COMMISSION (UK GOVERNMENT). 2022. Industry Statistics – July 2022 – Revision. [online]. Available from World Wide Web: <https://assets.ctfassets.net/j16ev64qyf6l/7BTu3TYDfDAOyov3XwUase/6e238e81b3be5dba0f2e7757ab70087b/Industry_Statistics_-_July_2022_Revision.xlsx>

GAMBLING COMMISSION (UK GOVERNMENT). 2023. Gambling business data on gambling to June 2023 (published August 2023). [online].

GAMBLING COMMISSION (UK GOVERNMENT). 2023. Register of gambling businesses. [online]. Available from World Wide Web: <https://www.gamblingcommission.gov.uk/public-register/businesses>

GAMBLING COMMISSION (UK GOVERNMENT). Customer Identity Verification. [online]. Available from World Wide Web: <https://www.gamblingcommission.gov.uk/licensees-and-businesses/lccp/condition/17-1-1-customer-identity-verification>

SELECT COMMITTEE ON THE SOCIAL AND ECONOMIC IMPACT OF THE GAMBLING INDUSTRY. 2020. Corrected oral evidence: Social and Economic Impact of the Gambling Industry. London: House of Lords.

SELECT COMMITTEE ON THE SOCIAL AND ECONOMIC IMPACT OF THE GAMBLING INDUSTRY. 2020. Gambling Harm—Time for Action. London: UK House of Lords.

UK LEGISLATION. 2017. The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. [online]. Available from World Wide Web: <https://www.legislation.gov.uk/uksi/2017/692/contents/made>

UNITED NATIONS. Money laundering methods. [online]. Available from World Wide Web: <https://syntheticdrugs.unodc.org/syntheticdrugs/en/cybercrime/launderingproceeds/methods.html>

WALMSLEY, David. 2014. Online Gaming and Betting – UK – October 2014. London: Mintel.

WALMSLEY, David. 2015. Online Gaming and Betting – UK – November 2015. London: Mintel.

WALMSLEY, David. 2016. Online Gaming and Betting – UK – November 2016. London: Mintel.

WALMSLEY, David. 2017. Online Gaming and Betting – UK – December 2017. London: Mintel.

WALMSLEY, David. 2020. Gambling Review: Inc Impact of COVID-19 – UK – June 2020. London: Mintel.

WALMSLEY, David. 2022. Gambling Trends – UK – 2022. London: Mintel.

WALMSLEY, David. 2023. Gambling Trends – UK – 2023. London: Mintel.

ZABOROWSKI, George. 2019. Online Gaming and Betting – UK – December 2019. London: Mintel.

[1] Sociocultural and demographics data of online gambling for year FYE2021 (2021 data) could not be found. Reports from previous and subsequent years do not show an increasing trend. Details see Sociocultural Trends section of this analysis.

[2] In terms of domain names. One licence may have registered multiple domains. Estimate made by filtering ‘poker’ in domain, which yielded thirty-two results that contain duplicates.